Getting started with trading is exciting — but it’s also where most beginners get burned. While enthusiasm runs high, many new traders fall into the same traps that quickly drain their capital and confidence.

The truth? Most trading losses aren’t caused by market unpredictability — they’re caused by poor habits and preventable errors.

Let’s uncover the top 5 mistakes new traders make, and how Algosignal.ai can help you sidestep them right from the start.

Poor Risk Management

The Mistake: New traders often bet too big, skip stop-losses, or keep adding to losing trades. It feels bold — but it’s reckless.

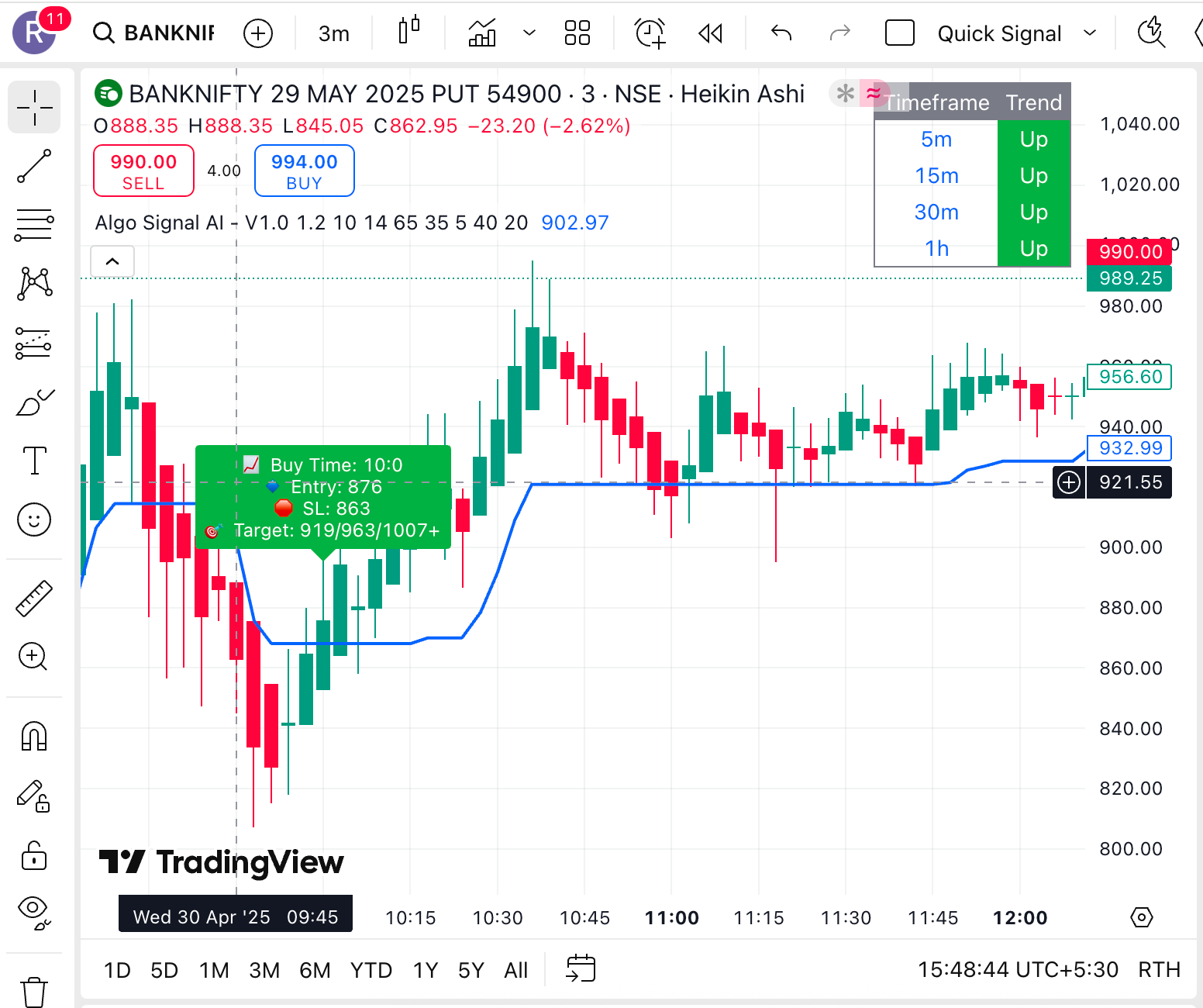

The Fix: A sound rule: never risk more than 1–2% of your total capital on a single trade. Always define your exit in advance.With Algosignal.ai, you get risk-aware signals with built-in volatility filters — so every trade is structured with your capital safety in mind.

Emotional Trading

The Mistake: Markets move fast — and so do your emotions. Fear of missing out (FOMO), panic after losses, or greed after wins can push you to act impulsively.

The Fix: Use a system that removes emotion from your decision-making. Algosignal.ai relies on AI and data-driven insights, not human bias. That means no panic buys, no emotional exits — just high-quality signals based on logic and analysis.

No Defined Trading Plan

The Mistake: Jumping into the market without a game plan is like going on a road trip without a map. You might move — but you’ll likely go in circles.

The Fix:

- Every trade should include:

- A clearly defined entry

- A target exit

- A stop-loss

- A reason based on strategy

Each signal from Algosignal.ai includes structured entry and exit points along with the rationale behind the trade — so you trade with clarity, not guesswork.

Overtrading

The Mistake: More trades don’t mean more profits. Many new traders keep clicking buy/sell without a solid setup, especially when bored or anxious.

The Fix: Discipline is more profitable than activity. Let Algosignal.ai help you filter out noise and focus only on high-probability trades. The platform avoids overtrading by sending alerts only when strong setups are detected.

Not Tracking or Learning from Trades

The Mistake: Ignoring your past trades is a missed opportunity to grow. Many traders repeat avoidable mistakes simply because they don’t review what went wrong.

The Fix:

- Start logging your trades. Reflect on decisions, analyze outcomes, and spot patterns.

- Algosignal.ai supports this with signal history and trade data that lets you review your performance — so you’re constantly improving.

Final Takeaway

You don’t need a decade of trading experience to avoid common beginner mistakes — you just need awareness and the right tools.

Algosignal.ai is built to guide you with smart, AI-backed trading signals that help you stay disciplined, reduce risk, and avoid emotional errors.

Want to stop trading blindly and start trading better?

Visit 👉 Algosignal.ai and level up your strategy today.